Dollars and demographics dominate in today's issue of the Harvard Joint Center for Housing Studies' (JCHS) latest biennial report on renovation and repair. Here are highlights from Demographic Change and the Remodeling Outlook.

Record Spending

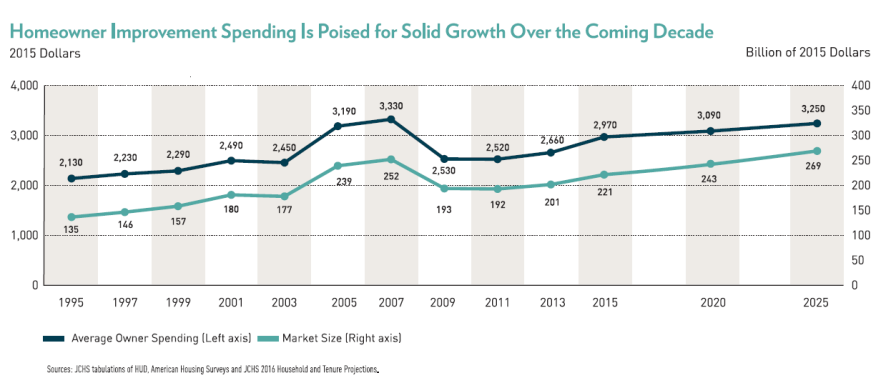

Spending on improvements and repairs by homeowners and rental property owners hit an estimated $361 billion in 2016, up 6% from $340 billion the year before. JCHS forecasts the homeowner improvement part of that total will rise an inflation-adjusted 2% per year (on average), from just over $220 billion in 2015 to almost $270 billion in 2025.

Boomers Rule

"Expenditures by homeowners age 55 and over are expected to grow by nearly 33% by 2025, accounting for more than three-quarters of total gains over the decade," JCHS said in a news release. "The share of market spending by homeowners age 55 and over is projected to reach 56% by 2025, up from only 31% in 2005."

Discretionary Work Rises

Back in remodeling's old peak year of 2007, discretionary projects--as opposed to work to replace broken or nonfunctioning devices--figured in more than 40% of spending. By 2015, it was down to a third. Going forward, "investment in discretionary projects is expected to drive overall market growth," JCHS predicts.

Bigger Outlays

The share of homeowners doing home improvement projects has remained consistently close to 30% since 1995. The differences in actual spending, then, spring mainly from the amount of money spent per owner. Measured in 2015 dollars, that amount peaked in 2007 at $3,330 before shrinking to $2,520 in 2011. Then it started recovering, and reached $2,970 per owner in 2015. It has been going up thanks largely to the return of discretionary spending, JCHS believes.

Who's Spending the Money

Over the past 20 years, the top 5% of spenders accounting for at least a third and up to half of all discretionary spending.

Where the Money Is

The 25 major metros tracked by the federal government's 2015 American Housing Survey contributed about 45% of the nearly $100 billion in owner home improvement spending, JCHS said. And it noted that per-owner spending in those markets--roughly $3,400--was 15% above the national average.

What About Other Generations?

In 2015, adults under age 35 comprised 19% of households but less than 10% of homeowners, and the homeownership rate for this group shrank from 43% in 2005 to just 31% in 2015. Blame credit card debt and lifestyle preferences for that drop, JCHS says, but you also need to figure in affordability.

A Potential Opportunity?

While a large percentage of baby boomers want to stay where they are, many won't be able to live on their own for health or financial reasons. JCHS predicts boomers will leave up to 12 million housing units for those reasons between 2015 and 2025. "Many of these homes are well-suited for younger families in that they are typically older and more affordable," the Joint Center writes. "And given that older households generally live in their homes for some time and spend little on improvements in their later years, younger buyers of these homes will likely want to invest in significant upgrades."